Boiler Room Defined

What is a Boiler Room?

Within the realm of investment and finance, a Boiler Room is a colloquialism given to investment endeavors that are deemed to operate in unlawful, unethical, and illegal manners. The term ‘Bucket Shop’ – which is classified as a type of Boiler Room – is defined as an investment firm or brokerage that conducts unlawful and illegal financial activity identifiable as securities fraud. While there does not exist a uniform procedure with regard to the process of a Boiler Room’s operation, standard Boiler Rooms retain similar qualities, which allow for their identification and potential criminal investigation:

Secrecy

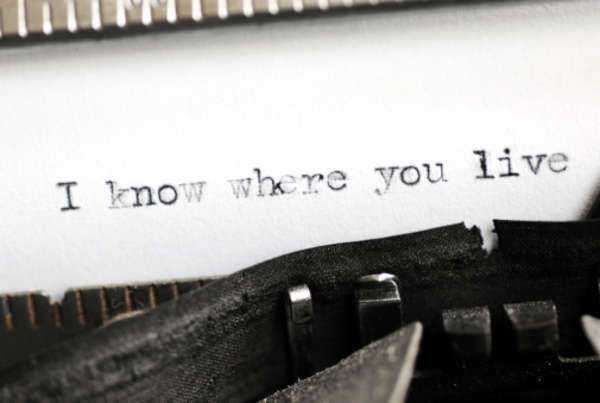

Typically, a Boiler Room will operate in a clandestine manner, which contributes to the masking of nature of its true purpose and structure; while many legitimate businesses operate from recognizable, observable, and stabilized locations, a Boiler Room may operate from a temporary facility absent of contact information disbursed to clients or other individuals unaffiliated with its operation. Furthermore, the temporary nature of a Boiler Room allow for the quick dissolution of the endeavor, which is contributory the constant movement undertaken by a variety of Boiler Rooms

Solicitation

A Boiler Room will typically accumulate clients through the use of high-powered, forceful, and abrasive solicitation. Due to the clandestine nature of a Boiler Room operation, individuals employed at a Boiler Room will rarely – if ever – encounter clientele in a face-to-face, physical setting:

A Boiler Room will typically target investors will large amounts of reported investment capital; these investors are typically older in age – the respective age of these investors is largely believed to be a means of exploitation.

The Boiler Room solicitation process undertaken by many of the employees involves high-pressured sales tactic, which have been described as ‘bullying’ and ‘pushy’ by those on the receiving end of the solicitation.

The Boiler Room solicitation methodology typically involves telephone-based sales tactics, which allows for an elevated number of sales calls performed in lieu of face-to-face meetings; this methodology supports the ideology of a Boiler Room is two ways – it allows for sales calls to be quick and short, as well as allows for anonymity.

Boiler Room Legality

While every Boiler Room operation is not inherently illegal, the large majority of Boiler Rooms retain unlawful and ethical qualities; these qualifications involve anonymous sales of deceitful investment opportunities in a fraudulent manner – oftentimes, the use of misrepresentation with regard to both the performance, as well as the expected gains are prominent:

A Boiler Room operation will employ tactics that involve the promise of large returns, which are conveyed to take place within a short period of time; this tactic creates an attractive – albeit fraudulent – investment opportunity with regard to the recipient of solicitation.

The movement of a Boiler Room from location-to-location allows for an element of untraceably with regard to the investigation of the implicit criminal nature undertaken; Boiler Rooms may reside in locations for time periods ranging from weeks to years.

The investment capital accrued as a result of solicitation will typically be funneled to the facilitators of the Boiler Room; this is substantiated as a result of fallacious reporting of losses suffered as a result of a respective investment.

What is Corporate Finance?

What is Corporate Finance?