401k rules

401(K) Qualification Rules:

For an employee to qualify for the tax benefits available, a plan must contain language that meets the IRS’s requirements and operate in accordance with the plan’s particular provisions. The following is an overview of qualification rules; it is not intended to be an all-inclusive list of regulations. For a complete list of plan qualification rules, observe Publication 560 of the Internal Revenue Service found at www.irs.gov.

Plan Assets Must Not Be Diverted: The 401(K) must make it impossible for the underlying assets to be used for or diverted to any purpose other than the benefit of the holder (the employee) and their direct beneficiaries. 401(k) rules—in the most general sense—state that the underlying assets cannot be diverted to the employer.

Benefits and Contributions must not Discriminate: Under the 401(k) plan, the contributions or benefits may not discriminate in favor of highly compensated workers. In most instances, an employee who makes over $110,000 per year or more are deemed as “highly compensated” employees for 2011 (this figure will increase to $115,000 in 2012). In order to meet this requirement—with regard to deferrals and employee matching contributions—a 401(k) plan may provide minimum employer contributions or meet the Actual Contribution Percentage or Actual Deferral Percentage tests.

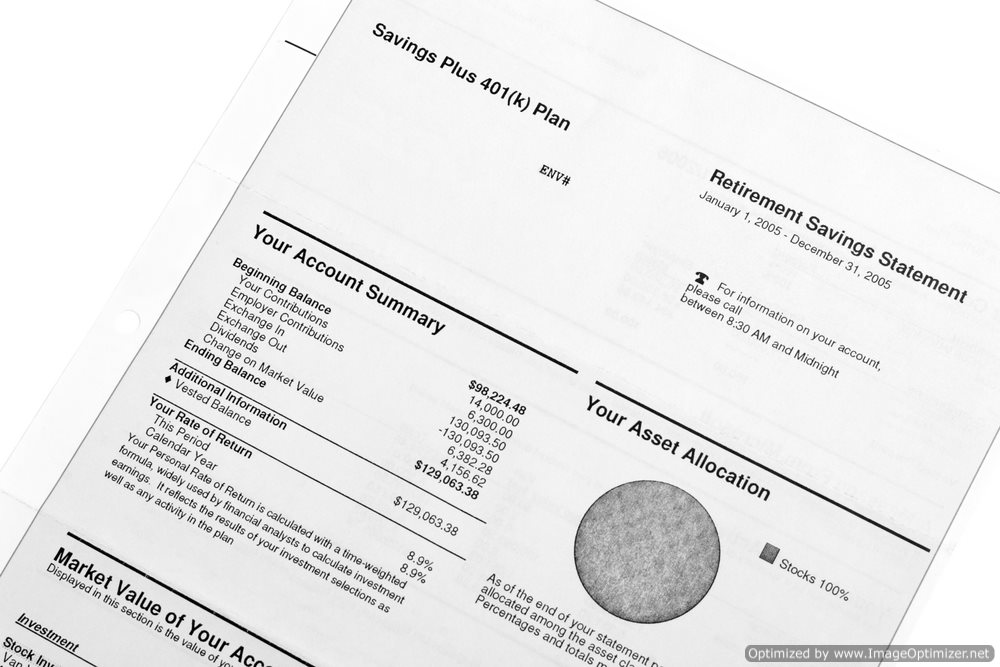

Allocations and Contributions are Limited: A contribution to 401(k) plans are not allowed to exceed certain limits described in tax code. The limits are attached to employer contributions and the amount of employee elective deferrals.

Elective Deferrals are Limited: 401(k) rules state that employee elective deferrals are capped to the amount in effect under section 402(g) under the IRC for that particular year. The elective deferral limit for 2011 is $16,500; this figure will increase to $17,000 in 2012. These caps are subject to cost-of-living adjustments; however, 401(k) plans may allow participants over or at the age of 50 to provide catch-up contributions of $5,000 in addition to these amounts.

Minimum Vesting Standards Must be Met: 401(k) plans must satisfy requirements concerning when benefits vest. To “vest” simply means to acquire ownership. Therefore, the vested percentage refers to the holder’s percentage of ownership in his or her 401(k) account. A participant must be 100% vested in their 401(k) elective deferrals. Moreover, a traditional plan may require the holder to complete a number of years of vested interest in matching or employer discretionary contributions.

401K Rules Regarding Participation: An employee, in general, is permitted to participate in a qualified retirement plan if the individual adheres to both of the following 401(k) rules:

• The individual must be at least 21 years of age

• The individual has at least 1 year of service; however, a traditional 401(k) plan may require 2 years of service for eligibility to obtain employer contributions if the plan provides that after no more than 2 years of service the participant is 100% vested in the account.

401(k) plans may not exclude an employee because the individual has reached a specified age.

Restrictions Associated with 401(k) Distributions: A distribution cannot be made until a “distributable event” occurs. “Distributable events” refer to instances that allow a transfer of funds from the employee’s plan and will include the following situations:

• The plan ends and not defined contribution plans are established or continued

• The employee becomes disables or passes away

• The employee reaches the age of 59 ½ years of age or suffers a financial hardship

Unless the participant wishes otherwise, the delivery of payment to the holder must begin with 60 days after the close of the following periods:

• The plan year in which the holder reaches the earlier age of 65 or the retirement age as specified in the plan.

• The year in which the participant destroys service with the employer.